IRS Definition of Cash Tips: A Comprehensive Guide for Taxpayers

IRS Definition of Cash Tips: A Comprehensive Guide for Taxpayers

Understanding the IRS definition of cash tips is crucial for anyone who receives tips as part of their income. Properly reporting tips is essential for avoiding penalties and ensuring compliance with tax laws. This comprehensive guide will delve into the IRS’s definition, reporting requirements, and potential consequences of non-compliance. We’ll cover various scenarios, providing clarity and practical advice for taxpayers of all levels.

What Constitutes a Cash Tip Under IRS Guidelines?

The IRS defines a tip as any money or other gratuity given directly to an employee by a customer. This includes cash payments, but also extends to other forms of compensation, as we’ll discuss later. The key element is that the payment is voluntary and given in appreciation for service. The amount isn’t predetermined; it’s based on the customer’s discretion and satisfaction.

Let’s break down the key components of the IRS definition:

- Voluntary: The customer must freely choose to give the tip. It can’t be a mandatory charge or a service fee added to the bill.

- Gratuity: The payment is given as an expression of appreciation for service, not for goods sold or for any other obligation.

- Directly to an Employee: The tip must be given directly to the employee receiving the service, not to the employer or establishment.

This definition is broad, covering a range of situations. It’s important to remember that the IRS considers even small amounts of cash received as tips and subject to reporting requirements.

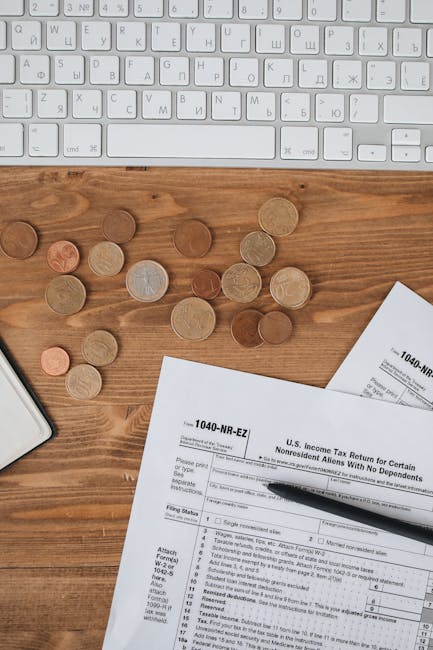

Reporting Cash Tips: Understanding Your Obligations

The IRS requires accurate and timely reporting of all cash tips received. Failure to do so can result in significant penalties. The methods for reporting cash tips vary depending on the circumstances:

Reporting for Employees Who Receive $20 or More in Cash Tips in a Month

If an employee receives $20 or more in cash tips during a calendar month, they are required to report these tips to their employer by the 10th day of the following month. This is done using Form 4070, Employee’s Report of Tips to Employer. The employer then reports the tips on the employee’s W-2 form.

This is a crucial step, ensuring both the employee and the employer are compliant with IRS regulations. Failing to report these tips on Form 4070 can lead to penalties for both the employee and employer.

Reporting for Employees Who Regularly Receive Tips

For employees who regularly receive tips, such as waiters, waitresses, bartenders, and taxi drivers, accurate tracking of cash tips is paramount. Maintaining detailed records is crucial to ensure accurate reporting. This can include keeping a daily log of tips received, along with any other forms of compensation.

Employer’s Responsibilities Regarding Tips

Employers also have responsibilities when it comes to tips received by their employees. They are required to report the tips reported by employees on Form W-2. They must also withhold Social Security and Medicare taxes on the reported amount. Additionally, employers may be required to report tips received through other methods such as credit card tips or tip pooling arrangements.

Other Forms of Tips Considered by the IRS

While the focus is often on cash tips, the IRS also considers other forms of compensation as tips that need to be reported. These include:

- Credit Card Tips: Tips paid directly to the employee via credit card are considered tips and should be reported accordingly.

- Charge Card Tips: Similar to credit card tips, these tips paid directly to the employee via a charge card are also considered tips and must be reported.

- Tip Pools: In some industries, employees pool their tips and then distribute them among themselves. Each employee is responsible for reporting their share of the tip pool as income.

- Non-Cash Tips: While less common, non-cash tips, like gift certificates or other goods, have a taxable value and should be reported as income.

Penalties for Non-Compliance

Failing to properly report cash tips can have serious consequences. The IRS imposes penalties for underreporting or non-reporting of tips. These penalties can include:

- Back Taxes: The taxpayer will owe taxes on the unreported tips, plus interest.

- Penalties: Significant penalties can be assessed for intentional disregard of tax laws.

- Interest Charges: Interest will accrue on unpaid taxes.

- Criminal Prosecution: In cases of significant tax evasion, criminal prosecution may be pursued.

Tips for Accurate Tip Reporting

To avoid penalties and ensure accurate reporting, consider these tips:

- Keep Accurate Records: Maintain a detailed record of all tips received, including the date, amount, and method of payment.

- Report Tips Timely: Submit Form 4070 to your employer promptly by the 10th day of the following month.

- Understand Your Responsibilities: Familiarize yourself with the IRS guidelines and your specific obligations as an employee.

- Consult a Tax Professional: If you have questions or uncertainties about reporting tips, seek the guidance of a qualified tax professional.

Conclusion

Understanding the IRS definition of cash tips and adhering to the reporting requirements is crucial for every taxpayer who receives tips as part of their income. Accurate reporting avoids potential penalties and ensures compliance with tax laws. By maintaining detailed records and following the guidelines outlined in this guide, taxpayers can navigate the complexities of tip reporting and maintain a compliant tax profile.

Remember, this guide provides general information and does not constitute legal or tax advice. Always consult with a qualified tax professional for personalized advice tailored to your specific situation.